On March 27th, President Trump enacted the Coronavirus Aid, Relief, and Economics Security (CARES) Act. The historic $2.2 trillion stimulus bill includes a $349 billion paycheck protection program (PPP) that targets aid to small businesses dealing with losses resulting from the coronavirus pandemic.

The PPP uses the already-existing small-business loan framework of the Small Business Administration (SBA) but includes some changes. The SBA was already impacted by provisions included in the March 6 stimulus law, the Coronavirus Preparedness and Response Supplemental Appropriations Act (CRPSA). The CRPSA expanded the qualification criteria for SBA loans under the organization’s Economic Injury Disaster Loan Program (EIDLP).

Below, we address some of the common questions we are encountering about the PPP. If you cannot find an answer to your question, please do not hesitate to reach out to your Abeles and Hoffman accounting advisor for further assistance.

What is the Paycheck Protection Program?

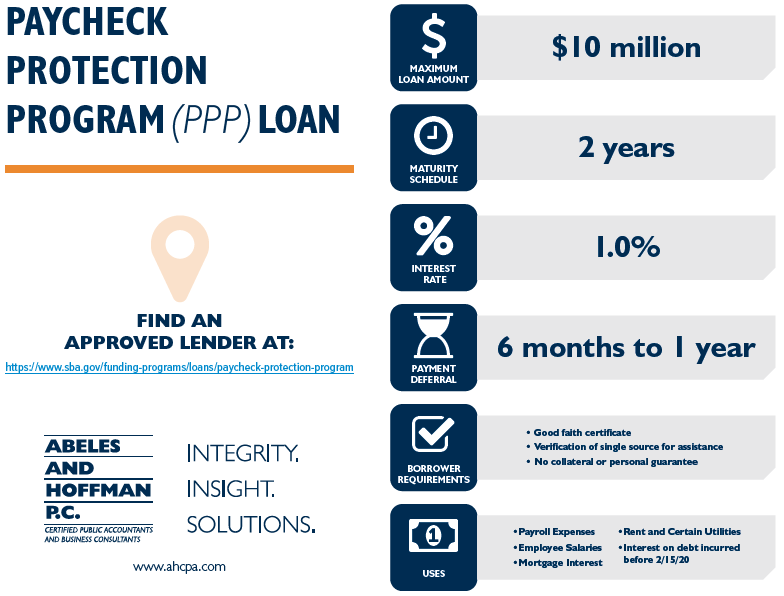

The CARES Act designates $349 billion for general business loans to be distributed under section 7(a) of the Small Business Act during a designated “covered period,” February 15 through June 30, 2020. Borrowers can qualify for up to $10 million in 100% federal government guaranteed covered loans. Under the CARES act, the portion of these loans that is used for allowable purposes is eligible to be forgiven.

Who qualifies for the program?

First, businesses and other entities seeking PPP loans must have been in operation on February 15, 2020. Eligible recipients include the following, provided that they employ not more than the greater of (a) 500 employees or (b) the number of employees established as the size standard by the SBA (if applicable):

- Small businesses

- IRC Section 501(c)(3) nonprofits

- IRC Section 501(c)(19) veterans’ organizations

- Tribal businesses under Section 31(b)(2)(C) of the Small Business Act

Additionally, the following individuals are eligible for a PPP:

- Sole proprietors

- Independent contractors

- Eligible self-employed individuals

When applying, sole proprietors, independent contractors and eligible self-employed individuals must submit documentation that establishes their eligibility (payroll tax filings, 1099s, and income/expense details for sole proprietorships).

Eligible businesses can be precluded from receiving loans through the PPP by certain business affiliations. If the business is affiliated with a larger business (greater than 500 employees), they may be disqualified from participating in the PPP. An affiliation exists in two cases:

- One business controls another (or has the power to control it)

- A third-party controls multiple businesses (or has the power to control them)

When determining whether affiliation exists, the SBA considers such factors as ownership, management, previous relationships with or ties to another business concern, and contractual relationships.

Additionally, the PPP expands eligibility to certain businesses with multiple locations, provided that each location has fewer than 500 employees. These eligible businesses have a North American Industry Classification System (NAICS) code that begins with 72 (accommodation and food services sector). The CARES Act waives affiliation rules for these businesses.

How much are the loans under the PPP?

The maximum loan amount is $10 million, though not every applicant is eligible for that much. There are three methods by which an entity’s loan amount can be calculated:

- For entities in business from February 15, 2019 – June 30, 2019: Calculate your average total monthly payments for payroll during the one-year period before the loan is made and multiply it by 2.5.

- For entities that were not in business from February 15, 2019 – June 30, 2019: Calculate your average total monthly payments for payroll between January 1, 2020 and February 29, 2020 and multiply it by 2.5.

- For entities that took out an Economic Injury Disaster Loan (EIDL) between February 15, 2020 and June 30, 2020: You can refinance your loan into a PPP loan. Add the outstanding EIDL loan balance to the amount determined under number 1 or 2 above.

What representations do I need to make to the lender?

As part of your application, you need to certify in good faith that:

- Current economic uncertainty makes the loan necessary to support your ongoing operations.

- The funds will be used to retain workers and maintain payroll or to make mortgage, lease, and utility payments.

- You have not and will not receive another loan under this program.

- You will provide to the lender documentation that verifies the number of full-time equivalent employees on payroll and the dollar amounts of payroll costs, covered mortgage interest payments, covered rent payments, and covered utilities for the eight weeks after getting this loan.

- All the information you provided in your application and in all supporting documents and forms is true and accurate. Knowingly making a false statement to get a loan under this program is punishable by law.

- You acknowledge that the lender will calculate the eligible loan amount using the tax documents you submitted. You affirm that the tax documents are identical to those you submitted to the IRS. And you also understand, acknowledge, and agree that the lender can share the tax information with the SBA’s authorized representatives, including authorized representatives of the SBA Office of Inspector General, for the purpose of compliance with SBA Loan Program Requirements and all SBA reviews.

How can the loan money be used?

Allowable uses of the PPP loans include:

- Salaries, wages, commissions, or similar compensations (up to $100,000 per year per employee, prorated)

- Cash tips or equivalent

- Employee leave, including parental, family, medical, or sick (excluding family or sick leave under the Families First coronavirus Response Act)

- Allowances for dismissal or separation

- Group healthcare benefits, including insurance premiums

- Retirement benefits

- State or local taxes on employee compensation (not including the employer’s share of FICA payroll taxes, railroad retirement act taxes, or other required U.S. income tax withholding)

- Continuation of group healthcare benefits during employee leave and insurance premiums

- Mortgage interest, rent, utility payments, and interest on any other debt obligations incurred prior to February 15, 2020

Additionally, sole proprietors and independent contractors may use the loan money to cover compensation and income of up to $100,000 per year (prorated).

I’ve heard that these loans can be forgiven…how does that work?

Loan money used for any of the allowable purposes listed above during an 8-week period beginning on the date of the PPP loan origination is eligible to be forgiven. Forgiveness is based on the employer maintaining or quickly rehiring employees and may be reduced if full-time headcount decreases or if salaries and wages decrease. Additionally, recent guidance from the SBA suggests that at least 75% of any amount to be forgiven must have been used for payroll.

How can I request loan forgiveness?

You will need to submit a request to the lender that is servicing the loan. The request will include documents that verify the number of full-time equivalent employees and pay rates, as well as the payments on eligible mortgage, lease, and utility obligations. You must certify that the documents are true and that you used the forgiveness amount to keep employees and make eligible mortgage interest, rent, and utility payments. The lender must make a decision on the forgiveness within 60 days.

What if I use the money for a non-allowable purpose?

Loan money used for non-allowable purposes must be repaid. Any balance remaining after the amount used on allowable purposes is forgiven will continue to be a fully guaranteed loan.

What if I can obtain credit elsewhere?

While normally SBA loans only go to borrowers who cannot obtain credit elsewhere, for PPP loans, this requirement is waived.

What fees are associated with getting a PPP loan?

All service fees, prepayment fees, and borrower guarantees are waived for PPP loans.

What sort of collateral or personal guarantees are required?

Loans covered under the PPP require neither collateral nor personal guarantees, if the money is used for allowable purposes.

What is the interest rate on the loans?

The interest rate will be fixed at 1%.

Updated 4/3/2020 10:04 am.

What are the payment terms?

All payments are deferred for 6 months; however, interest will accrue on the unpaid balance during that time. The balance of the loan must be paid within 2 years and there will be no prepayment penalties or fees.

How do I apply for the program?

The SBA and the Department of Treasury have approved thousands of institutions to be authorized lenders for the PPP. You can contact any local banking institution to find out if they are an approved lender. Additionally, you can reach out to an SBA development center for local assistance in finding a lender

When can I apply for the program?

- April 3, 2020 – Small businesses and sole proprietorships can apply for loans through existing SBA preferred lenders.

- April 10, 2020 – Independent Contractors and self-employed individuals can apply for loans through existing lenders.

- Other regulated lenders will be available to make loans as soon as they are approved and enrolled in the program.

What do I need to apply?

You will need to complete the Paycheck Protection Program loan application and submit the application with the required documentation to an approved lender that is available to process your application by June 30, 2020. Click here for the application. Please note that you will also need to provide your lender with payroll documentation.

How long will this program last?

Although the program is open until June 30, 2020, we encourage you to apply as quickly as you can because there is a funding cap and lenders need time to process your loan.

In Closing

As with many of the recent relief provisions, we expect additional guidance to be forthcoming and we will endeavor to keep you updated as this situation evolves. If you have questions or wish to discuss these matters, please contact us.

Sincerely,