Abeles and Hoffman, PC is excited to announce the following recent promotions: Michele Duvall has been promoted to Senior Tax Manager. Jacob Maret has been promoted to Tax Manager Nick Coco has been promoted to Senior Audit Associate These promotions are a testament to the dedication and excellence these individuals bring to their work each day. We are proud...

Dear Clients and Friends, On July 4, President Trump signed into law the sweeping One Big Beautiful Bill Act (OBBBA). This bill is a landmark tax and spending package that makes key provisions from the 2017 Tax Cuts and Jobs Act (TCJA) permanent, introduces significant changes for businesses and individuals, and redefines international tax...

Dear Clients and Friends, We are writing to share an important update released last week by the Internal Revenue Service and the Missouri Department of Revenue regarding the tax relief for individuals and businesses in parts of Missouri that were affected by severe storms, straight-line winds, tornadoes, and floodings that began on March 14,...

To our Clients and Friends: The less hectic summer season is a good time to consider steps to cut your 2025 tax bill. Here are some planning strategies to consider, assuming our current federal tax regime remains in place through 2025. Establish a Tax-favored Retirement Plan If your business doesn’t already have a retirement...

Dear Clients and Friends, We are writing to share important information released this past week by the Internal Revenue Service and the Missouri Department of Revenue providing tax relief for individuals and businesses in parts of Missouri that were affected by severe storms, straight-line winds, tornadoes, and wildfires that began on March 14, 2025. These taxpayers now have...

Dear Clients and Friends, We are writing to inform you of significant developments in federal tax legislation. On May 22, 2025, the House of Representatives passed H.R. 1, the “One Big Beautiful Bill Act,” a sweeping $3.8 trillion reconciliation package that includes a broad array of tax provisions affecting individuals, businesses, and international taxpayers. While...

Dear Valued Client, We are writing to share important updates regarding recent changes to retirement savings rules under the SECURE Act 2.0, which may help you maximize your retirement contributions—especially if you are approaching retirement age. Super Catch-Up Contribution for Ages 60–63 Starting January 1, 2025, individuals who turn 60, 61, 62, or...

Brad Danner, CPA, joined Abeles and Hoffman P.C. in 2019 and serves as a Tax Manager. In his role, Brad provides tax compliance, consulting, and planning services for C Corporations, S Corporations, Partnerships, and high-net-worth individuals. He works with clients across a broad range of industries, including architecture, engineering, law, healthcare, manufacturing, real estate, and...

The Financial Crimes Enforcement Network (FinCEN) issued an interim final rule that removes the requirement for U.S. companies and U.S. persons to report beneficial ownership information (BOI) to FinCEN under the Corporate Transparency Act (CTA), P.L. 116-283, passed by Congress in 2021. The rule revises the definition of “reporting company” to mean only those entities...

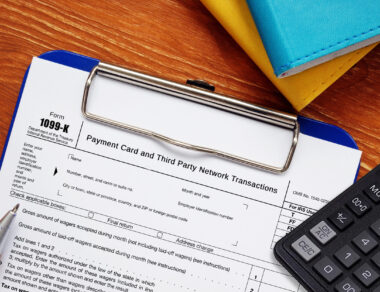

The landscape of digital transactions has undergone a significant transformation over the past few decades, prompting the Internal Revenue Service (IRS) to introduce and adapt tax reporting mechanisms to keep pace with the evolving nature of online payments and e-commerce. One such adaptation is the Form 1099-K, “Payment Card and Third Party Network Transactions,” a...